Hope you’ve all had a good Summer!😎

Since President Trump’s inauguration into office on January 20, 2025 we’ve observed his style – to remain unpredictable with how he’s dealing with tariffs and interest rates. Meanwhile, the business world craves predictability. The stock market needs direction as to what the government’s long term strategy is.

Since January, the market has been quite volatile

However, it appears the business community and investors are starting to understand how President Trump operates and with this, we’re seeing the stock market show signs of fair to good returns. This is especially true since April 2, 2025.

The need remains for retirees to have a good budget, long-term income plan, health care plan and an estate or legacy plan.

But surveys are showing that retirees need more cash for their long-term retirement plans

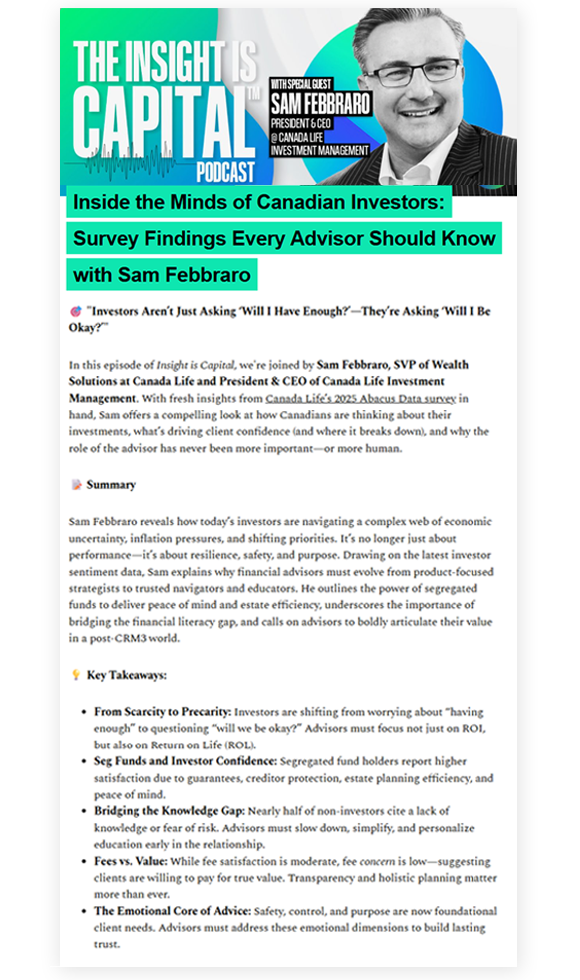

I’m hearing this – and you aren’t alone. 1,500 of your fellow Canadians said the very same things in Canada Life’s 2025 Abacus Data Survey. Check out the highlights provided in the following article by Sam Febbraro, President & CEO @ Canada Life Investment Managment:

You can also access this Sam Febbraro article/podcast here

Understandably, clients are asking:

“Are there any new investment strategies we should be exploring?”

The answer is Yes!

One of the more attractive investment alternatives is an investment called Exchange Traded Funds (ETFs) (a type of investment fund that is traded on a stock exchange). These are one of the most popular investment programs in North America. In Canada alone the approximate assets under administration are $314 Billion. Here are 3 examples of Exchange Traded Funds:

- Canada S&P/TSX – this is made up fo the top blue-chip companies in Canada.

(This is a capitalization-weighted equity index that tracks the performance of the largest companies listed on Canada’s primary stock exchange, the Toronto Stock Exchange (TSX). It is the equivalent of the S&P 500 index in the United States, and as such is closely monitored by Canadian investors.)

→ Year to date return is approx. 10.2% - S&P 500 Composite – this is made up of your top 500 blue chip companies in the U.S

(Formally known as the ‘Standard & Poor’s 500 Composite Stock Price Index’ the S&P 500 is often treated as a proxy for describing the overall health of the stock market and even the economy.)

→ Year to date return is approx. 12.1%

→ Warren Buffet suggests buying the S&P500 - Nasdaq – this is made up of the largest non-financial companies such as technology, healthcare and consumer staples

(“National Association of Securities Dealers Automated Quotations” is an American stock exchange based in New York City.)

→ Year to date return is approx. 12.6%

Capture your profit now!!!

What clients are doing is looking at taking profit – because these are very good short-term returns.

Another step in this strategy is buying monthly into these index funds – catch highs and lows of the market.

Clients are more actively involved in their portfolio and they use the profit for:

- Gifts

- Credit card elimination

- Home improvements

- Or cash

💡How we activate this strategy: buy an index fund or a group of them and also buy every month. Then capture the profits each time they pop up!

Tax-Free Savings Accounts (TFSAs) are the most popular investment vehicle for this strategy

📁Ted’s Case Study

Since April 2, 2025 we have one client who has followed this program – she has invested her money in the S&P TSX – in this short period of time, she has captured profit of approx. 20% since her initial purchase in April 2025. She will be using these profits for a holiday this winter😎!!! Her TFSA is tax-free profit.

Buy a Lump sum, purchase monthly, take the profit and keep buying monthly.

Be Diversified, be active!! Review this strategy, capture your profits sooner rather than later!

As we quote Angie in the office: “Let’s get at ‘er!”