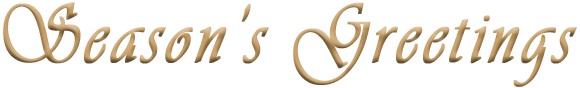

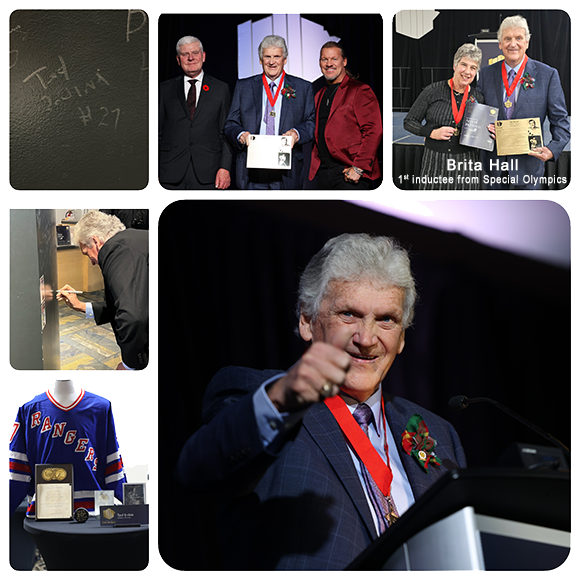

What an exciting and big year 2024 was. I was inducted into the Manitoba Sports Hall of Fame – what an honour! Thanks to all my friends and family who reached out with their support.❤️I also I turned the Big 80!!! Thank you for all the birthday wishes.

We would like to also thank our clients who have participated in these “Professor Ted” eNewsletters. We’re thrilled that every eNews earns a >200% average open rate. This tells us readers are spotting nuggets of info they value and are returning to reference/read it again. We’ll continue to work at earning your valuable attention.

And your responses are directing the content we share. Thanks to your input, we’re hearing that retirees and clients like the strategies, but want more actual numbers.

You want it? You got it!

We’ve discussed Tax-Free Savings Accounts (TFSAs) and it turns out that in last year’s market, the one investment product that attracted the most attention has been TFSAs. BMO (Bank of Montreal) announced (in this article) that the average amount of money clients put into TFSAs was $44,987. The annual TFSA contribution limit for 2025 is $7,000 making the cumulative total contribution limit $102,000.

Baby Boomers have the highest amount of TFSA holdings with approx. $72,000 per individual.

What attracted the most money in investment funds? Canadian Exchange-Traded Funds (ETFs) had net sales of almost $75 Billion in 2024. More than double the total in 2023.

Here’s a couple of examples of how Index Funds have performed for the calendar year 2024:

- Nasdaq 100 index top 100 technology companies in the U.S – the 1 year return 33%

- S&P 500 index top 500 blue chip companies in the U.S – the 1 year return 31.23%

- S&P TSX index top companies in Canada the Toronto Stock Exchange – the 1 year return 18.6%

Source: “S&P 500 reaches record highs as Trump pushes for lower rates and oil prices”

Looking at 2025:

If you would like to participate in the “Trump Bump” part 2 (if it happens) here’s a concept that clients are reviewing:

- Purchase a lump sum Exchange-Traded Fund or an Index Fund

- Control volatility within your portfolio, buy an Exchange-Traded Fund or Index Funds every month. This enables you to catch the highs and the lows of the market with a structured monthly payment.

💡Another “Trump Bump” concept:

If you score unusual returns like what happened all last year, here’s the secret sauce… sell some of your profit and go back into a cash money market. But keep saving monthly.

Trump Bump 1 & Trump Bump 2

or

Clean up on aisle 9?

Give yourself a target for profit and what would you do with this profit? Set a goal!!!

Clients have been using this strategy for the last year and have had very good returns and then withdrew profits. You can stop these deposits anytime and sleep at night keeping your brain active!!

Questions?

What is keeping you up at night? What do you need to know more about?

Let us know! OR are you a fan of enjoying profits?😊Call us (204) 774-9529 or schedule a time that’s best for you through our online calendar here: calendly.com/tedirvine